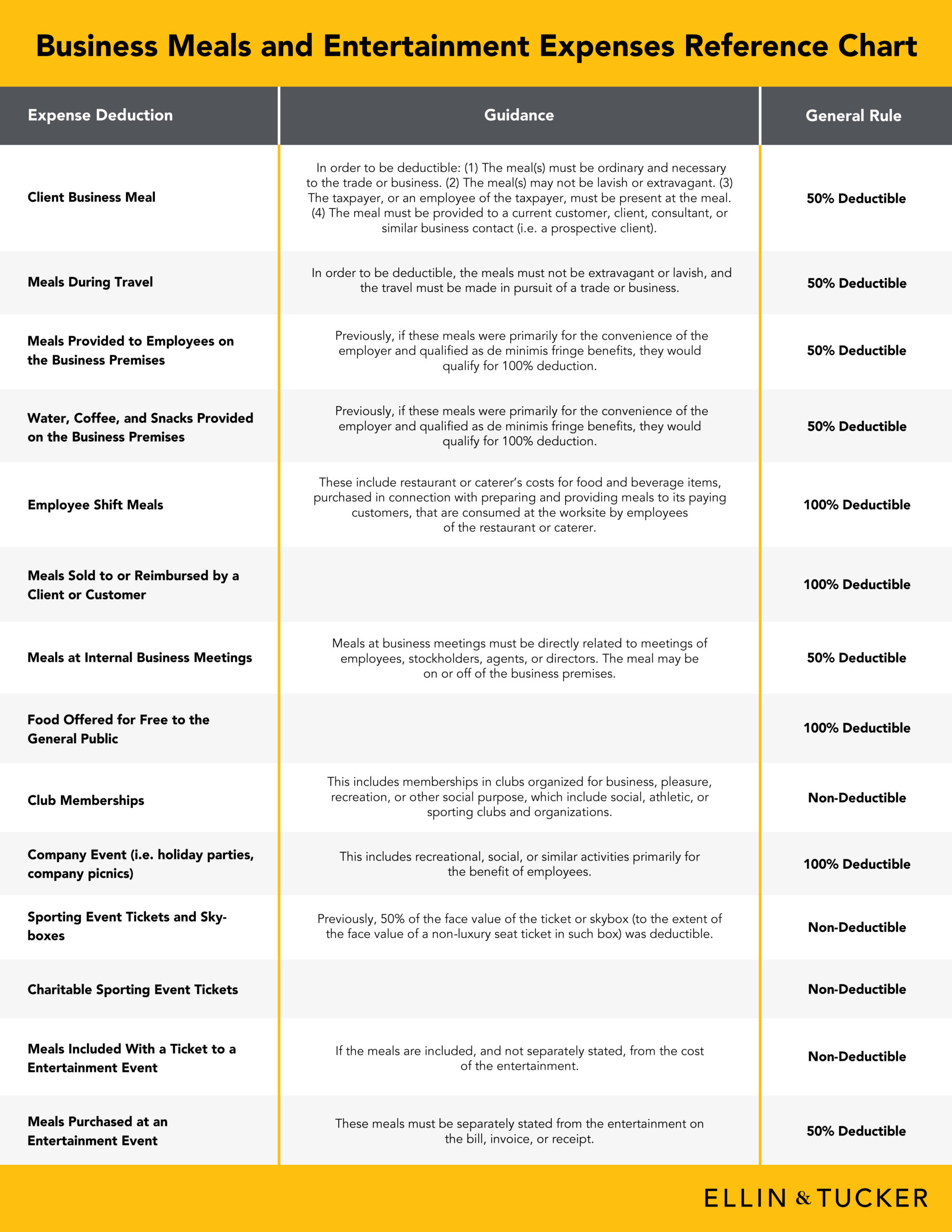

2025 Meals Expense Deduction. Are business meals still 100% deductible in 2025? Business meals are generally 50% deductible in 2025.

Tax time can be confusing, especially when it comes to figuring out what meal and entertainment. One of the key changes in meal deductions in 2025 is the reduction in the deductible percentage.

100 Deduction for Business Meals in 2025 and 2025 Alloy Silverstein, Temporary deduction of 100% business meals. For 2025 and 2025, most business meals are only 50% deductible, according to the current irs rules.

How to Deduct Business Meals in 2025 Ultimate Guide, Your guide to meal tax deduction for 2025 and 2025. Claim deductions for meals and entertainment — bookkeeperlive.

Expanded meals and entertainment expense rules allow for increased, What is the meal deduction for 2025? Specific changes to business meal deductions.

Check, Please Deductions for Business Meals and Entertainment Expenses, You may deduct 50% of the total cost of a business meal. Keep reading as we share the ins and outs of the meal and.

Meals and Entertainment Deduction 2025, Business meals are generally 50% deductible in 2025. Temporary deduction of 100% business meals.

Meals & Entertainment Deductions for 2025 & 2025, Specific changes to business meal deductions. Sadly, the value of the meal deduction will be cut in half for 2025 from the 2025 deduction levels.

Meals & Entertainment Deduction 2025 5 MustKnow Tips FlyFin, Tax treatment of fixed monthly meal allowances, meal allowances for working overtime, reimbursements for food and drinks for meetings, etc. This includes the enhanced business meal deduction.

Meal Entertainment Deduction Meal Expenses OH KY IN, Claim deductions for meals and entertainment — bookkeeperlive. Learn about eligibility, limits, and maximize your tax savings with expert advice.

Can You Deduct Meals As A Business Expense Charles Leal's Template, This includes the enhanced business meal deduction. Business meals are generally 50% deductible in 2025.

Writing off Dining Expense and Food in 2018 Mark J. Kohler, However, there are certain situations where meals can be 100%. Prior to 2025, taxpayers could deduct 50% of their meal expenses incurred.